塑膠五金手辦模型、模具、注塑一站式服務商 | 0769-82388092

熱搜關鍵詞:3D打印 快速成型 手板模型 醫療儀器手板 汽車配件手板 家電機殼手板 電子數碼手板 玩具概念手板

宏晶佳的優勢

品質+效率保證,滿足定制加工,多樣化需求

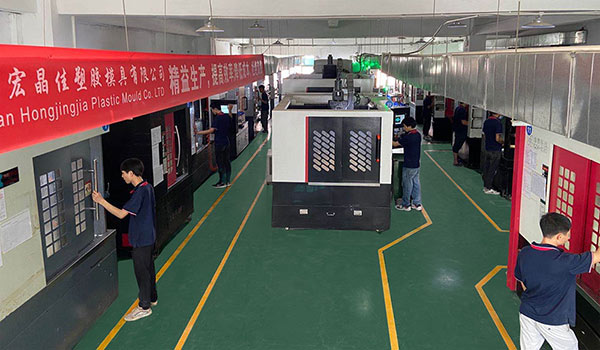

NO1 實力雄厚 經驗豐富

先進生產設備和經驗豐富工程技術人員

擁有二十多年的從業經驗的工程技術人員,以及經驗豐富的技師團隊。

25臺注塑設備、3D打印SLA激光成型設備10臺、CNC機加設備50臺、多臺真空批量澆注復模機等設備。

NO2 匠心工藝延續個性品質

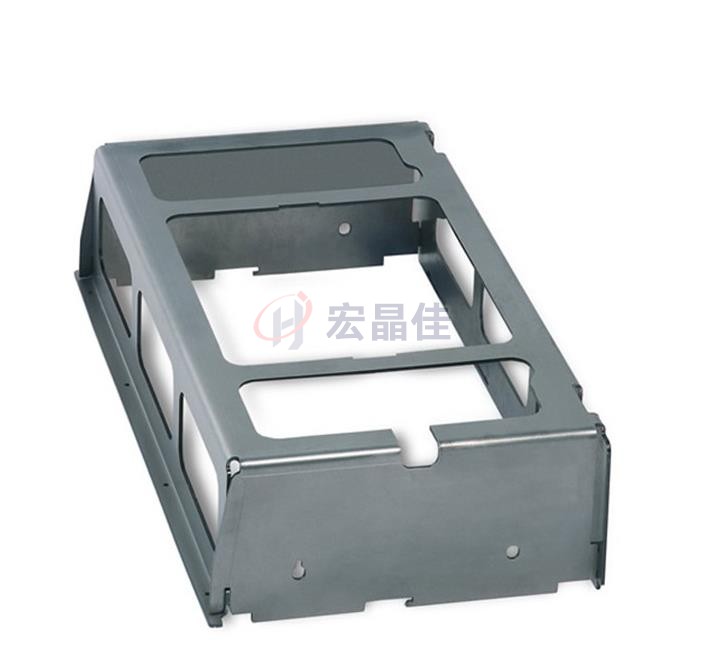

主要服務項目

塑膠、鋁合金、五金手板模型制作、3D打印、復模制作、模具制造 、注塑成型等;各類智能機器人、家電、玩具、汽車、運動器材、醫療器材、軍工、消防、金融、數碼等金屬與非金屬制作及批量生產。

NO3 安全環保

安全環保,交貨周期迅速

生產的產品符合環保標準,可以完成的工序有:噴油(光色、啞色、橡膠油、透明色、半透明色、熒光色)、絲印、電鍍、陽極處理、鐳射、噴砂、UV、燙金等。交貨周期迅速。

NO4 售后服務快速響應

服務更專業

公司秉承誠信、團結、創新、感恩的核心價值觀,堅持為客戶提供“卓越的產品、真誠的服務”的經營方針,按照“以人為本,與客共贏,共同追求,共創未來”的服務標準。

新聞動態

品質+效率保證

24 2025-08

24 2025-08

14 2025-07

14 2025-07

11 2025-06

11 2025-06

07 2025-06

12 2025-05

24 2025-08

14 2025-07

11 2025-06

07 2025-06

07 2025-06

12 2025-05

29 2025-03